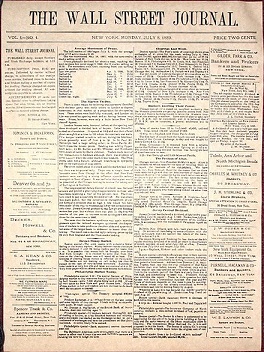

1889 picture of WSJ courtesy of wikipedia.com

My broker called this week. He wanted me to buy stock in a company that is building a gas pipeline somewhere. I told him no. I’m not a purist when it comes to investing. Oil and gas are still a part of our energy picture, but I won’t support new construction on a pipeline when we should be turning to alternatives as fast as we can.

Many investors agree with me. The money people have spent buying up renewable energy stocks over the last year has grown by $20.6 billion. (The Week, January 31, 2020, pg. 33.) What’s more, twenty funds that adhere to Environmental, Social and Governance Criteria (ESG) outperformed the general market, too. (Ibid, pg. 3.) ESG investments have become so popular, the Security and Exchange Commission sent out a letter to money managers warning them to study these funds and understand how they work. By law, a financial adviser’s objective is to maximize a client’s profits not further altruistic goals. (Ibid, pg. 33)

Types of ESG funds vary. Some focus on climate change. Others support companies with a diversified workforce. Many charge low fees, which may be another reason why they are popular.

The number of investors who show a concern for the environment is likely to grow as younger people enter the market. Nonetheless, I mustn’t get too Pollyannaish. The stocks that have performed well over the past 17 years are the Vice Funds. You know the ones: alcohol, cigarettes, gambling, and defense.